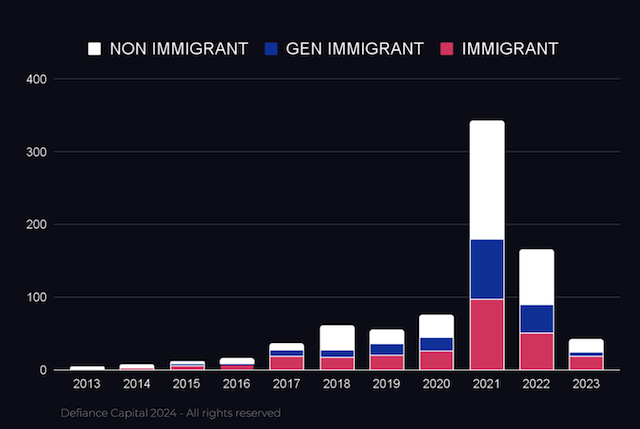

The “Unicorn Founder DNA Report” by Defiance Capital studied the ‘DNA’ of 845 unicorns and 2,018 unicorn founders, focusing on the U.S. and U.K. from 2013 to 2023.

According to the results, only 21% of immigrant and female founders raised funds from top 10 VCs. At the same time, it looks like male immigrant founders with STEM degrees from elite universities were favored by investors at the seed stage.

Women weren’t that successful, however. Although 17% of unicorns had a female founder in 2023, they’ve been largely ignored by VC funds.

Some other major findings include:

- 38% of unicorns had at least one founder who was not white: 82% had at least one white founder.

- Every third unicorn had an Asian founder. Only 3% of unicorns had a black founder.

- 53% of unicorn founders have degrees from the top 10 global universities.

- 49% of unicorn CEOs had STEM degrees (64% of female founding CEOs had STEM degrees), and 70% of founder teams have STEM degrees.

- Serial founders (50%) were more likely to succeed building unicorns, but only one in five unicorns had solo founders.

Contrary to popular belief, the stereotypical founder archetype — white, male, local, Ivy League-educated — was actually a rarity, constituting only 11% of cases.

Only 28% of “underdog founders” had raised capital from a top VC seed fund (with more than 1% market share). Outside of SV Angel (6.4%) and YC (10%), no other VC fund got into more than 2.8% (Sequoia) of unicorns.

The study identified three dominant factors in the ‘DNA’ of a unicorn founder.

- No ’Plan B’

- ‘A chip on their shoulder’ (feeling unfairly treated or limited in opportunities)

- Unlimited self belief

Many of these founders also exhibit traits of being “ambitious rebels,” often driven by a deeper cause they passionately support, influenced by strong family role models, possessing quality peer networks, and harboring no fear of failure.

On average, it took seven years for all types of founder teams to achieve unicorn status, whereas second-generation immigrants accomplished this milestone in just six years.

“With only 10% of unicorn founders fitting the Mark Zuckerberg profile, most of the thousands of seed funds are backing the wrong type of founders,” Defiance Capital founder Christian Dorffer told Techcrunch. “A lot of immigrant founders are coming from the developing world, like India and Africa, even Eastern Europe. They don’t really have that many options at home. They have to leave and pursue opportunities elsewhere.”